After the Budget 2019, what is the Mutual Fund Taxation FY 2019-20? What is the Mutual Funds tax rate for FY 2019-20?

3 Factors that determine the Mutual Fund Taxation

First, let us understand what are the factors that determine the Mutual Fund Taxation. The three major part of these are below.

# Your Residential Status-Resident or Non-Resident (NRI)

Your tax will be based on your residential status. If you are resident then the taxation rules will be different and if NRI then it differs. Hence, first, you have to make sure of what is your residential status.

# Types of Funds-Equity Funds or Non-Equity Funds-

Any fund which invests 65% or more in equity is called as Equity Fund. For example, large-cap funds, multi-cap funds, small and mid-cap funds or equity-oriented balanced funds (where the equity exposure is 65% or more) are all called equity-oriented funds.

If the equity portion is less than that, then they are all treated as debt funds or non-equity funds. For example liquid funds, ultra-short term funds, short-term funds, income funds, gilt funds, debt-oriented balanced funds, gold funds, fund of funds or money market funds.

# Holding periods of Investment–

The holding period for Equity and Debt Funds will be different for taxation purpose. For equity funds, if the holding period more than a year, then it is called long term. If the holding period is less than a year, then such equity mutual funds holding period is considered as short term. Whereas in

Whereas in the case of debt funds, holding period more than 3 years is considered as long-term. If holding period of debt funds is less than 3 years, then it is considered as short-term and taxed accordingly.

Now you got the clarity on what will be STCG and LTCG. Let us move further and understand the Capital Gain Taxation for mutual fund investors.

Mutual Fund Taxation FY 2019-20 -Capital Gain Tax Rates

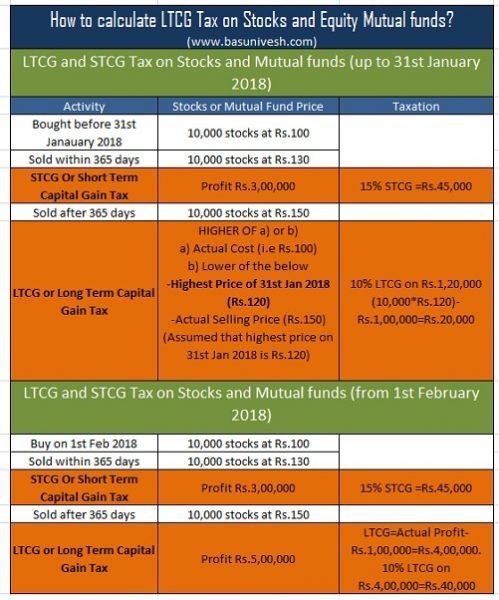

The biggest change from FY 2018-19 is the introduction of LTCG in Budget 2018. There is no change in Mutual Fund Taxation FY 2019-20. Hence, let me explain the same from below image.

Note-Surcharge @ 15%, is applicable where the income of Individual/HUF unit holders exceeds Rs. 1 crore. Also, surcharge @10% to be levied in case of individual/ HUF unitholders where the income of such unitholders exceeds Rs.50 lakhs but does not exceed Rs.1 Cr. Further, Health and Education Cess @ 4% will continue to apply on the aggregate of tax and surcharge.

As you may be aware that during Budget 2018, LTCG was introduced again to Equity Funds. Hence, let me explain the same on how to calcualte the LTCG on Equity Funds as below.

Mutual Fund Taxation FY 2019-20 – Dividend Distribution Tax (DDT)

There are few investors who opt for dividend option in mutual funds. Hence, let us see the taxation on the dividend of such funds. Earlier there was no DDT for equity investors. However, from the Budget 2018, DDT @10% will be applicable to equity investors also.

Security Transaction Tax (STT) for FY 2019-20

Security Transaction Charges or STT is the charges or tax when you buy or sell securities (excluding commodities and currency) through a recognized stock exchange. Therefore,

The definition of securities involves the below products.

- Shares, scrips, stocks, bonds, debentures, debenture stock or other marketable securities of a like nature in or of any incorporated company or other body corporate;

- Derivatives;

- units or any other instrument issued by any collective investment scheme to the investors in such schemes;

- Security receipt as defined in section 2(zg) of the Securitisation and Reconstruction of Financial Assets and Enforcement of Security Interest Act, 2002;

- Government securities of equity nature;

- Rights or interest in securities;

- Equity-oriented mutual funds

Therefore, whenever you buy and sell these securities through a recognized stock exchange, then you have to pay this STT.

Source: Basunivesh.com

Source: Basunivesh.com

Financial

Advisory Company in Indore, Stock

Advisory Company in Indore, Equity Tips, FreeTrading Tips , MCX Tips, sebi registered advisory company, Intraday

stock tips, Free

commodity tips